south dakota property tax abatement

VACANT LAND 0080 - INDUSTRIAL 0081 - INDUSTRIAL VACANT LAND 0082 - 10-30 IND. Since becoming governor in 2019 Whitmer has authorized another 2 billion in subsidies Hohman wrote adding that amount equals the annual operating costs of Michigans Department of Corrections.

South Dakota Property Tax Relief Archives Knbn Newscenter1

Resolve judgements liens and debts.

. Dereliction of duty generally refers to a failure to conform to rules of ones job which will vary by tasks involved. It also discusses reasonable cause criteria per IRC 6724 and 26 CFR 3016724-1. ASCII characters only characters found on a standard US keyboard.

If no candidate received a majority the top two vote-getters advanced to the general election. California voters have now received their mail ballots and the November 8 general election has entered its final stage. Donations are tax-deductible as allowed by law.

Supreme Court in the case of South Dakota v. The median annual property tax payment in Norfolk County is 5592. It is a failure or refusal to perform assigned duties in a satisfactory manner.

Section 103 of the BIRT regulations were amended to reflect the ruling of the US. Do not enter information in all the fields. Minnesota Missouri Nebraska North Dakota or South Dakota and.

The Business Support Office BSO is. Microsofts Activision Blizzard deal is key to the companys mobile gaming efforts. South Dakota also has both excellent self-settled trust as well as third party discretionary trust statutes both allowing for domestic asset protection planning with.

When searching choose only one of the listed criteria. The median home value in Norfolk County is 452500 more than double the national average. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

When searching choose only one of the listed criteria. Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in property tax bills to a maximum of 3 for homeowners. Compared to the 107 national average that rate is quite low.

Recovering Possession of Property. Madison County Property Tax Inquiry. He emphasized money directed from taxpayers to businesses are direct payments rather than tax abatements.

The states average effective property tax rate is just 053. Pay outstanding tax balances. The surprising truth about content.

Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. That is also well over double the national average. To eject remove or relieve tenants or other persons from and recover possession of any property real personal or mixed in which I now or hereafter may have an interest.

All operating division employees who address information return penalties. We recently joined Ryan an award-winning global tax services and software provider and the largest Firm in the world dedicated exclusively to business taxesRyan provides an integrated suite of federal state local and international tax services on a multijurisdictional basis including tax recovery consulting advocacy compliance and. Property Classes VACANT LAND 0060 - IMPROVED COMMERCIAL 0061 - COMMERCIAL VACANT LAND 0062 - COMMERCIAL VACANT LAND 0065 - COMMERCIAL WITH FARM 0070 - COMMERCIAL IMPROVEMENTS 0072 - 10-30 COMM.

Must contain at least 4 different symbols. Taxpayer deducts no more than. The Nature Conservancy is a nonprofit tax-exempt charitable organization tax identification number 53-0242652 under Section 501c3 of the US.

Thank you for visiting Paradigm Tax Group. Get a property tax abatement. Thus while property tax rates in the county are not especially high on a statewide basis property tax bills often are high.

6 to 30 characters long. Block Tax Services today by calling 410 793-1231 or completing this brief form. The property tax date in South Carolina is January 15.

While licenses arent a requirement at the state level for more trades all contractors engaged in construction need to register for a South Dakota Contractors Tax License with the. Sacramento County California held primary elections for assessor district attorney sheriff county board of supervisors county board of education and superior court judges on June 7 2022Candidates could win outright with a majority of the vote in the primary. To search for tax information you may search by the 15 to 18 digit parcel number last name of property owner or site address.

Amid rising prices and economic uncertaintyas well as deep partisan divisions over social and political issuesCalifornians are processing a great deal of information to help them choose state constitutional officers and. Additionally South Dakota has the lowest insurance premium tax of any state ie 8 basis points or 8100ths of 1 and also offers other very favorable insurance legislation. When correspondence is received requesting abatement of the penalty use the following table to help you decide if the IRC 6723 Penalty may be abated.

To institute maintain defend compromise arbitrate or otherwise dispose of any and all actions suits attachments. The number of American households that were unbanked last year dropped to its lowest level since 2009 a dip due in part to people opening accounts to receive financial assistance during the. Madison County Property Tax Inquiry.

Electrical and plumbing contractors however receive licenses from the Department of Labor and Regulation. Taxpayer provides proof of duty-related meal restriction requirements from his employer and. Appeal a property assessment.

If you would like to schedule a free consultation to discuss your personal or business tax issues or ask any filing questions please contact SH. This IRM provides policy and procedures for the application of information return penalties assessable under IRC 6721 IRC 6722 and IRC 6723. Prop 30 is supported by a coalition including CalFire Firefighters the American Lung Association environmental organizations electrical workers and businesses that want to improve Californias air quality by fighting and preventing wildfires and reducing air pollution from vehicles.

Lexis has the largest collection of case law statutes and regulations Plus 40K news sources 83B Public Records 700M company profiles and documents and an extensive list of exclusives across all. As opposed to North Dakota which has a property tax below the national average Mount Rushmore State has an average estimated tax rate of 122. The most convenient way to pay is online by visiting your countys treasurer or revenue department.

South Dakotas licensing falls on municipalities. Do not enter information in all the fields. To search for tax information you may search by the 15 to 18 digit parcel number last name of property owner or site address.

State Lodging Tax Requirements

Do You Know Your Homestead Exemption Deadline

State Tax Treatment Of Homestead And Non Homestead Residential Property

Understanding Your Property Tax Statement Cass County Nd

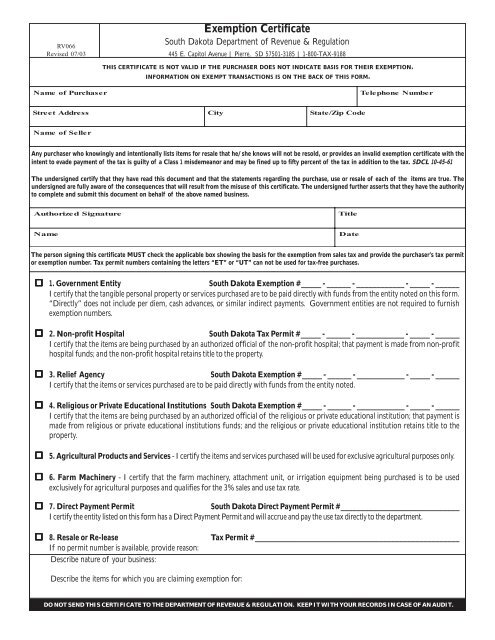

South Dakota Tax Exemption Certificate Physiologics

Property Tax South Dakota Department Of Revenue

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Relief Programs South Dakota Department Of Revenue

Veteran Tax Exemptions By State

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

Tangible Personal Property State Tangible Personal Property Taxes

Pdf Comparison Of Selected Nebraska Tax Incentives With Tax Incentives In Other States Kathryn Gudmunson Academia Edu

Historical South Dakota Tax Policy Information Ballotpedia

Sales Taxes In The United States Wikipedia

Why The Superrich Are Flocking To South Dakota The Nation

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Property Tax Comparison By State For Cross State Businesses

South Dakota Estate Tax Everything You Need To Know Smartasset